Are You Eligible?

Given below are the eligibility requirements to avail loans at CarePal Money

Nationality

Indian

Age

23 to 65 Years

Residency Type

Owned or Rented

Credit Score

650 or higher

Employment Type

Salaried, Self-Employed

Monthly Income

INR 18000 or higher

Work Experience / Business

Continuity 1 year

Why Choose CarePal Money?

CarePal Money Schemes

Choose from a variety of flexible and customized lending schemes here:

| Scheme | Tenure (in months) |

Advance EMI* | Remaining EMI** |

|---|---|---|---|

| 4/1 | 4 | 1 | 3 |

| 6/1 | 6 | 1 | 5 |

| 9/3 | 9 | 3 | 6 |

| 12/4 | 12 | 4 | 8 |

| 18/6 | 18 | 6 | 12 |

| 24/9 | 24 | 9 | 15 |

*To be paid by the customer to the hospital.

**To be paid by the customer to NBFCs.

Disclaimer - changes subject to schemes being available in the hospital.

Examples

| Sr. No. | Particulars | Amount |

|---|---|---|

| a | Loan Amount | ₹1,20,000 |

| b | Scheme | 12/4 |

| c | EMI to customer for 1 month (a/12) | ₹10,000 |

| d | Advance EMI to be paid by customer to hospital | 4 |

| e | Advance EMI to be paid by customer to hospital (c*e) | ₹40,000 |

| f | Remaining EMI to be paid by customer to lender | 8 |

| g | Remaining EMI to be paid by customer to lender (c*f) | ₹80,000 |

| h | Total repayment by the customer (e+g) | ₹1,20,000 |

| Sr. No. | Particulars | Amount |

|---|---|---|

| a | Loan Amount | ₹40,000 |

| b | Scheme | 4/1 |

| c | EMI to customer for 1 month (a/12) | ₹10,000 |

| d | Advance EMI to be paid by customer to hospital | 1 |

| e | Advance EMI to be paid by customer to hospital (c*e) | ₹10,000 |

| f | Remaining EMI to be paid by customer to lender | 3 |

| g | Remaining EMI to be paid by customer to lender (c*f) | ₹30,000 |

| h | Total repayment by the customer (e+g) | ₹40,000 |

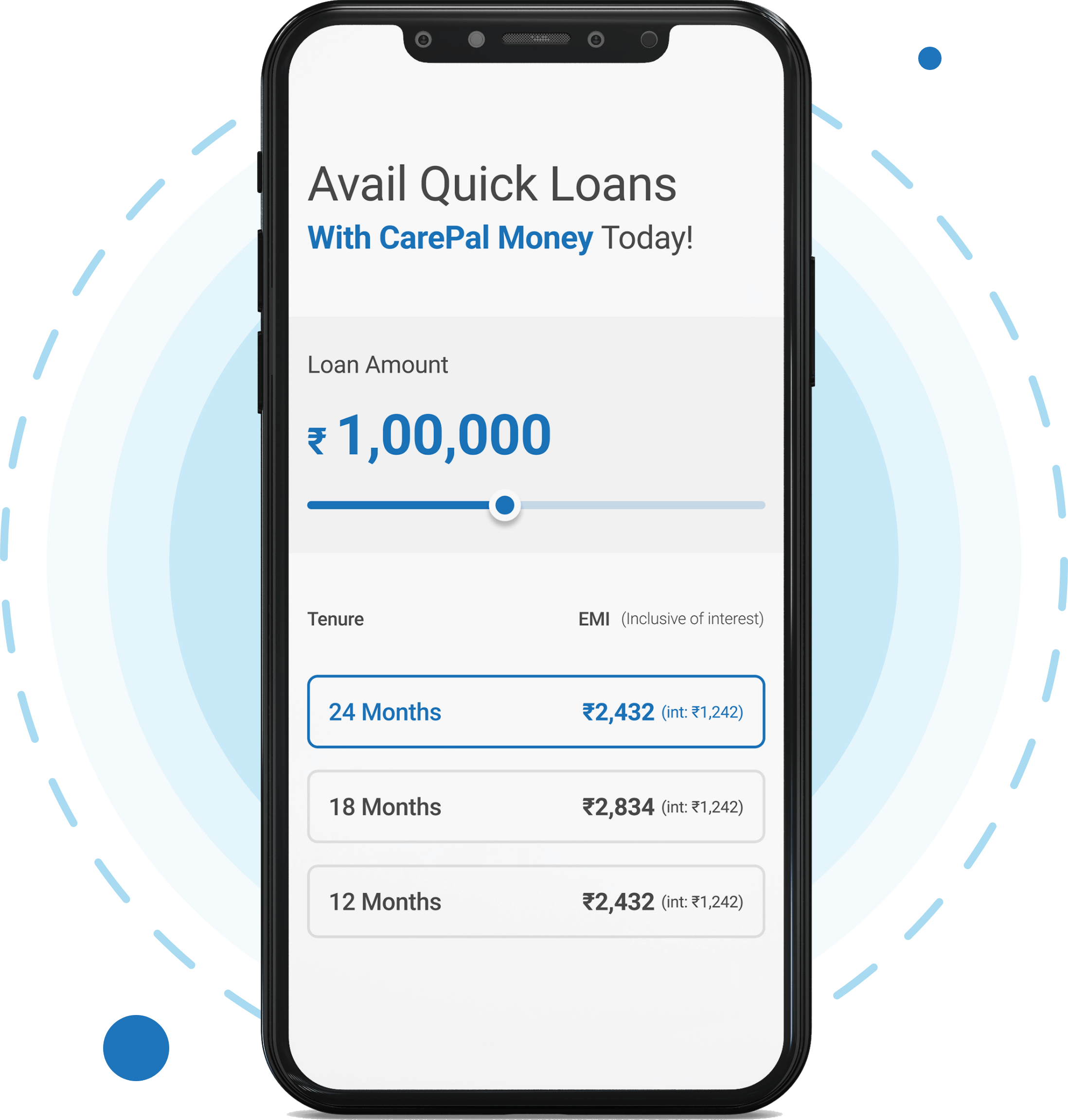

Calculate Your Loan EMI

Loan Amount

Tenure

Interest Rate

Your Calculated EMI

₹XYZ,123,12

FAQs

-

What is CarePal Money?

CarePal Money is a Lending Service Provider (LSP) that helps you cover the cost of elective medical treatments in partnership with RBI regulated entities/ NBFCs. Convert your medical bills into pocket-friendly EMIs with CarePal Money by availing of healthcare loans starting at 0%* EMI. CarePal Money will disburse the loan amount through partnered NBFCs.

-

Who can apply for a loan

with CarePal Money?

Any Indian citizen above the age of 23 years and below the age of 65 years can apply for healthcare loans at CarePal Money.

-

What is the interest

charged on loans availed from

CarePal Money?

Interest rates for loans availed on CarePal Money start at 0%*. Apart from this, you can choose from a variety of lending schemes having different terms and conditions including flexible interest rates. To know more about our lending schemes, connect with us at [email protected] / [email protected] or 1800 121 8200.

-

How do I apply for a loan

through CarePal Money?

Fill out the online loan application form provided on the website here. Get quick approval for a credit line of up to ₹5 Lakh online.

-

What are the documents

required for loan approval?

CarePal Money follows a thorough due diligence process where one submits their Aadhaar Card / Voter ID / Driving License / Passport, PAN Card Number and other necessary documentation based on the required loan amount and/or credit profile.

-

How 0% Financing (No

cost-EMI) works?

A no-cost EMI is an offer where you can pay for a product or elective medical treatment in affordable monthly installments with zero interest on your chosen tenure. This means that you are only paying for the total price of the product, with no charged interest.